Crypto Global

London upgrade for Ethereum

Jul 20, 2021

The crackdown on cryptocurrencies by various countries around the world, coupled with environmental concerns, seemed really to scare individual and institutional investors alike. After an explosive first half of the year, the crypto market has trended sideways in recent weeks. In terms of price, the market is currently not moving much. So what should an investor do? Buy more or sell more?

As you know, there are different types of trading. There are traders who try to make small profits from all the small increases and decreases in prices. And there are investors who buy and sell an asset and hold it for months or years. The latter can be a bit boring when the market has been trending sideways for weeks or months. Patience is required here. And the other thing is that one should pay attention to what is really going on besides the price movement. If you're wondering what the hell is going on with the crypto market, you might find the answers after doing more research.

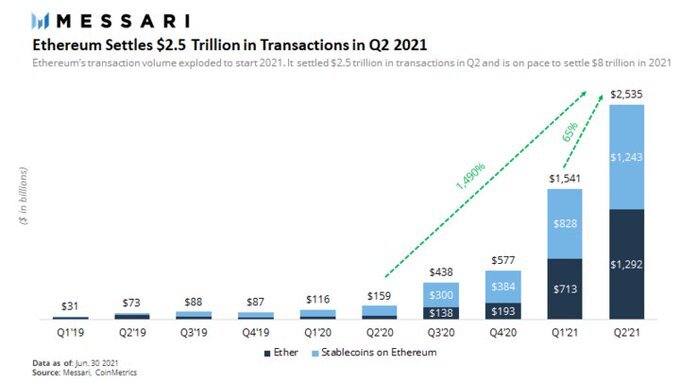

Today we want to talk about some amazing Ethereum [ETH] metrics that all Ethereum hodlers need to watch out for. Ethereum processed over $2.5 trillion in transactions in the second quarter of 2021, showing that ETH has never been this strong as a financial processing layer.

Source: Messari.io - Ethereum transaction volume

This is significant as it shows that the network continues to add participants and the demand for Ethereum is only growing. But why do we see such network growth when in the second quarter of 2021 the price of ETH has only gone down? Could this be a fundamental bullish indicator? Yes, it's due to the growing demand for stable coins on Ethereum. Stablecoins still accounted for roughly half of the total transactions for the quarter. If demand continues, according to this report from Messari, the Ethereum network is well on its way to processing over $8 trillion in transactions in 2021.

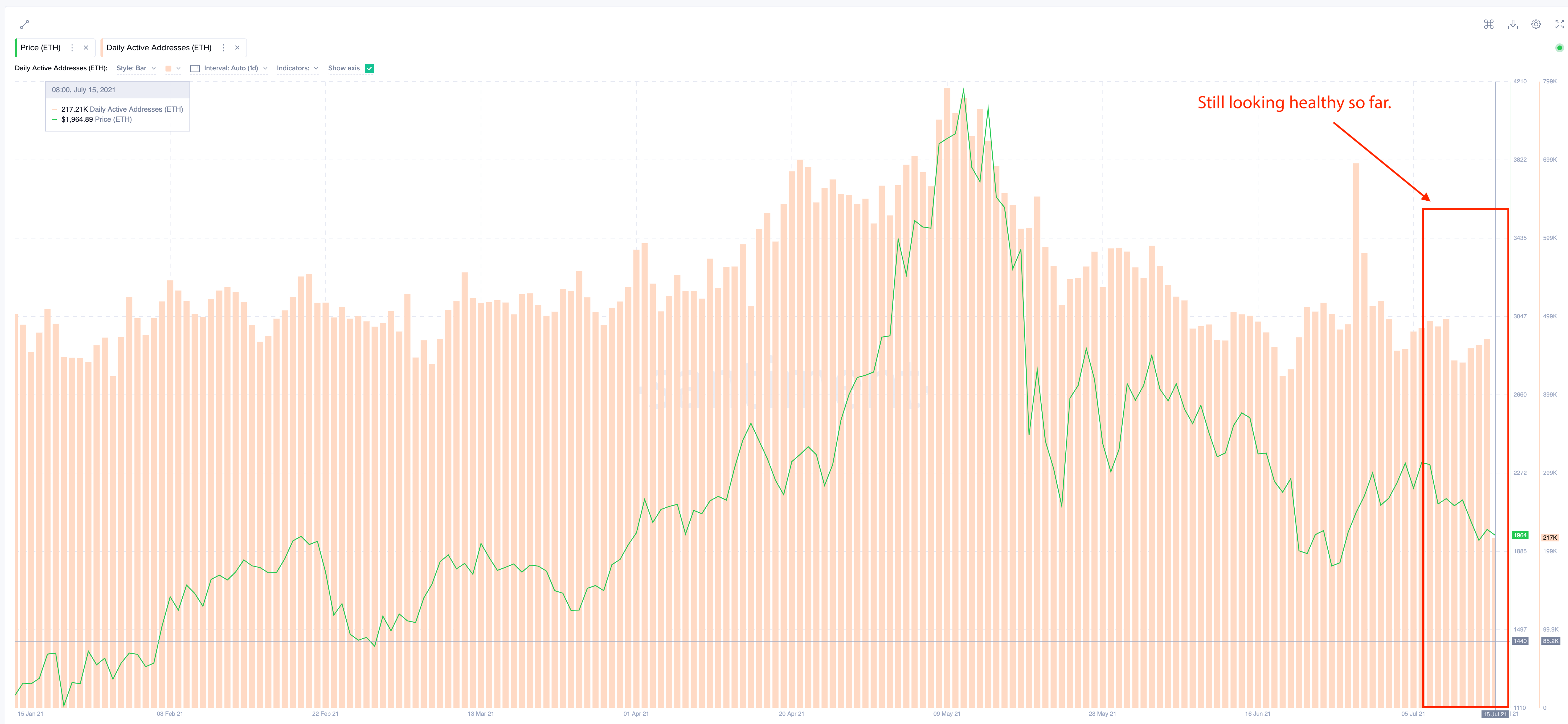

Another piece of information to watch out for as an Ethereum holder is the "Daily Active Addresses (DAA)".

Source: Sanbase - ETH Daily Active Addresses

Although the active Ethereum addresses were still high at around USD 4,000, you could see that it has remained quite stable so far, with an average of over 400,000 addresses interacting with the network since the beginning of the year. This is another interesting metric that shows you that the number of addresses that are on the network are still staying on and using the network, and that there are still many projects in progress in DeFi and NFTs.

There was also an official announcement from Ethereum.org stating that the London upgrade is ready to be activated on the Ethereum mainnet, which is expected to take place between August 3rd and 5th. This will be Ethereum’s biggest upgrade in recent years. In an article we published in April, we introduced Ethereum's "EIP 1559", which is part of the London upgrade, and explained the impact this will have on the Ethereum network. It aims to make the Ethereum network cheaper and faster by restructuring the transaction fees. There are also a few other EIPs included in the London upgrade such as EIP-3554, EIP-3198, EIP-3529, and EIP-3541.

If decentralization and, above all, sustainability are really what institutions are looking for in cryptocurrency, then such upgrades will be well received.