Crypto Research

Transaction fees for Ethereum are reaching record highs

Feb 16, 2021

If you've had anything to do with Ethereum at all lately, you've probably noticed that the high gas fees have made the network almost unusable. Once upon a time, the side effects of high gas fees were only felt by those using DeFi protocols and decentralized exchanges like Uniswap, where a simple swap could cost over $100 in gas fees. Even centralized exchanges like Binance charge over $40 in fees to transfer ERC20 stable coins like USDT and USDC.

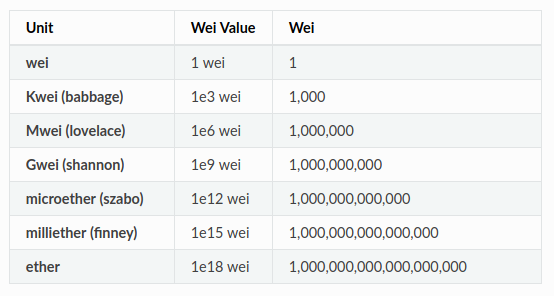

As a reminder, once again to explain: As with any other cryptocurrency, the Ethereum network incurs transaction fees known as gas. The fees for the Ethereum gas are measured in a unit called a gigaway or gwei. WEI is the smallest name of the ETH cryptocurrency.

Source: https://ethgasstation.info/blog/gwei/

These gas fees are paid to Ethereum miners to ensure the transaction is included in the next Ethereum block. Miners set the price of gas based on supply and demand for the network's computing power required to process smart contracts and other transactions. The Ethereum miners vote to set the so-called gas limit, which is the threshold that can be issued for transactions within a block. The reason miners are increasing the gas limit is because the Ethereum network can do more transactions per block. This theoretically makes the Ethereum a bit cheaper and faster for users without affecting the profits from transaction fees for Ethereum miners. The problem is that increasing the gas limit also increases the barrier to entry for new Ethereum miners and Ethereum nodes, which threatens the decentralization of the Ethereum network. Increasing the gas limit also does not change the fact that there is a limited transaction space in every Ethereum block. Even with a higher gas limit, if the Ethereum network is sufficiently busy, this means that a user has to pay a premium in order for the Ethereum miners to include their transaction in the next Ethereum block. So if the price of Gwei is high - let's say a few hundred Gwei - it is not much if the price of ETH is low. But if ETH breaks new all-time highs as it has done before, it can cost quite a bit in terms of US dollars. Of course, the more complex the transaction, the more Ethereum gas you have to pay to include a transaction in the next block.

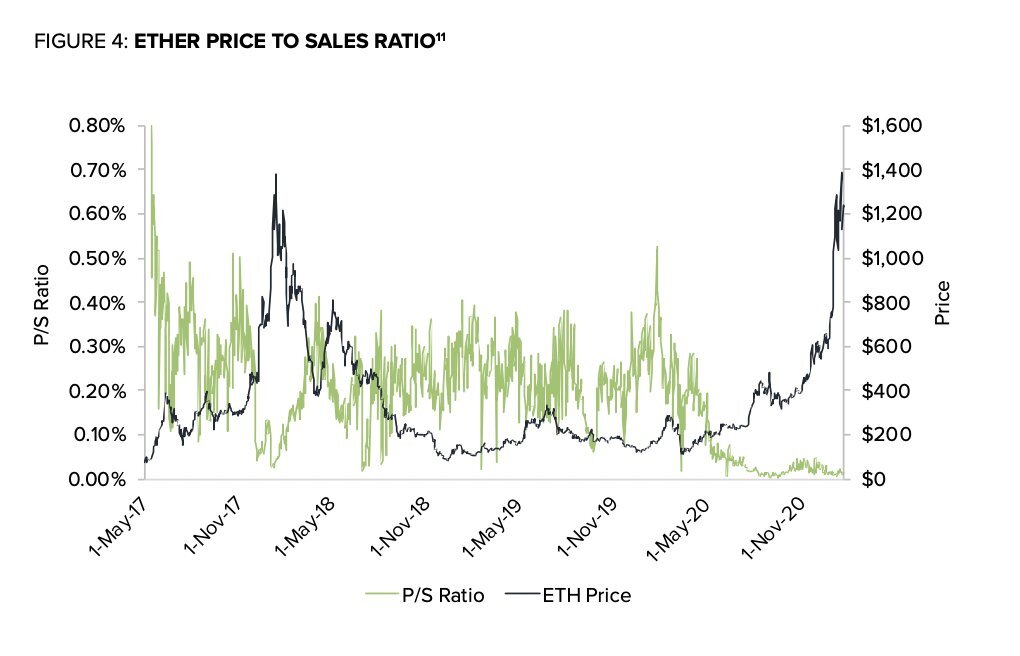

In a research report "Valuing Ethereum" recently published by Grayscale, it was pointed out that Ethereum is becoming cheaper in terms of the price-to-sales ratio (P/S ratio) and that high gas fees in relation to the current ETH price could actually be a bullish sign.

Source: "Valuing Ethereum" (Grayscale, 2021, page 6)

Interacting with most defi protocols currently costs hundreds of dollars to ETH. This makes using the network for smaller transactions completely unprofitable, eliminating a lot of DeFi activity for the average trader.

- However, there are many ways in which one can lower these Ethereum gas fees:

- One way to reduce gas charges is to conduct transactions during the quiet hours of the Ethereum network.

With almost every single Ethereum wallet you have, you can set your personal gas limit before sending a transaction. The gas limit seen in wallets like Myetherwallet and Metamask differs from the gas limit set by miners in each Ethereum block. The personal gas limit is essentially the maximum amount of Gwei one is willing to pay for this transaction. Many Ethereum wallets offer the option to send the transaction at slow, normal or fast speed.

It seems that gas charges cannot rise any further in the coming months. You may have to pay more than $1,000 for gas fees at some point if Ethereum prices hit $10,000 or $15,000 during this bull market. However, if you want to save these high gas charges in the future, you should prepare in advance to move these funds in good time (e.g. at the current gas charges) before you want to sell them. And if you want that, you do so at a time when the network is relatively less bloated.