Crypto Global

Terra (Luna) – The case with stablecoins

May 17, 2022

Today we look at what stablecoins are and most importantly, why some stablecoin concepts can be problematic.

The purpose of stablecoins is to stably reflect an equivalent value of a product in the real world. Stablecoins are digital assets, sometimes called coins, sometimes called tokens, that are designed to maintain their "stable" value. This value means experiencing only the type of volatility seen in traditional currencies, which exhibit price swings that are generally far less than Bitcoin's. A large proportion of stablecoins reflect the value of fiat currencies, e.g. USD, EUR etc. and even gold. Tether, for example, sells its coins for $1 and promises to redeem them for $1 if customers want their money back.

The Tether mechanism is quite simple and works like this: for example, someone who has 1 million USD and wants to convert it into a stablecoin can do it by going to the Tether company and that million USD for 1 million Tether-Coins received. And if you want to exchange them back, you always get that $1 million back from the Tether company and return the 1 million Tether coins. Ultimately, this stablecoin should reflect the same value as the US dollar.

However, other mechanisms exist to do this. Some mechanisms are linked to other cryptocurrencies and do this with an algorithm, such as the "innovative" stablecoin from Terra (Luna) or Terra Luna Foundation. Their stablecoin is called UST and behind it is a so-called anchor protocol, which is a lending protocol on the Terra cryptocurrency blockchain. This went live in March 2021 and was the largest DApp on Terra after “Total Value Locked” until last week. The Anchor protocol was popular because it allows earning a stable annual interest rate of around 20% per year on the UST stablecoin.

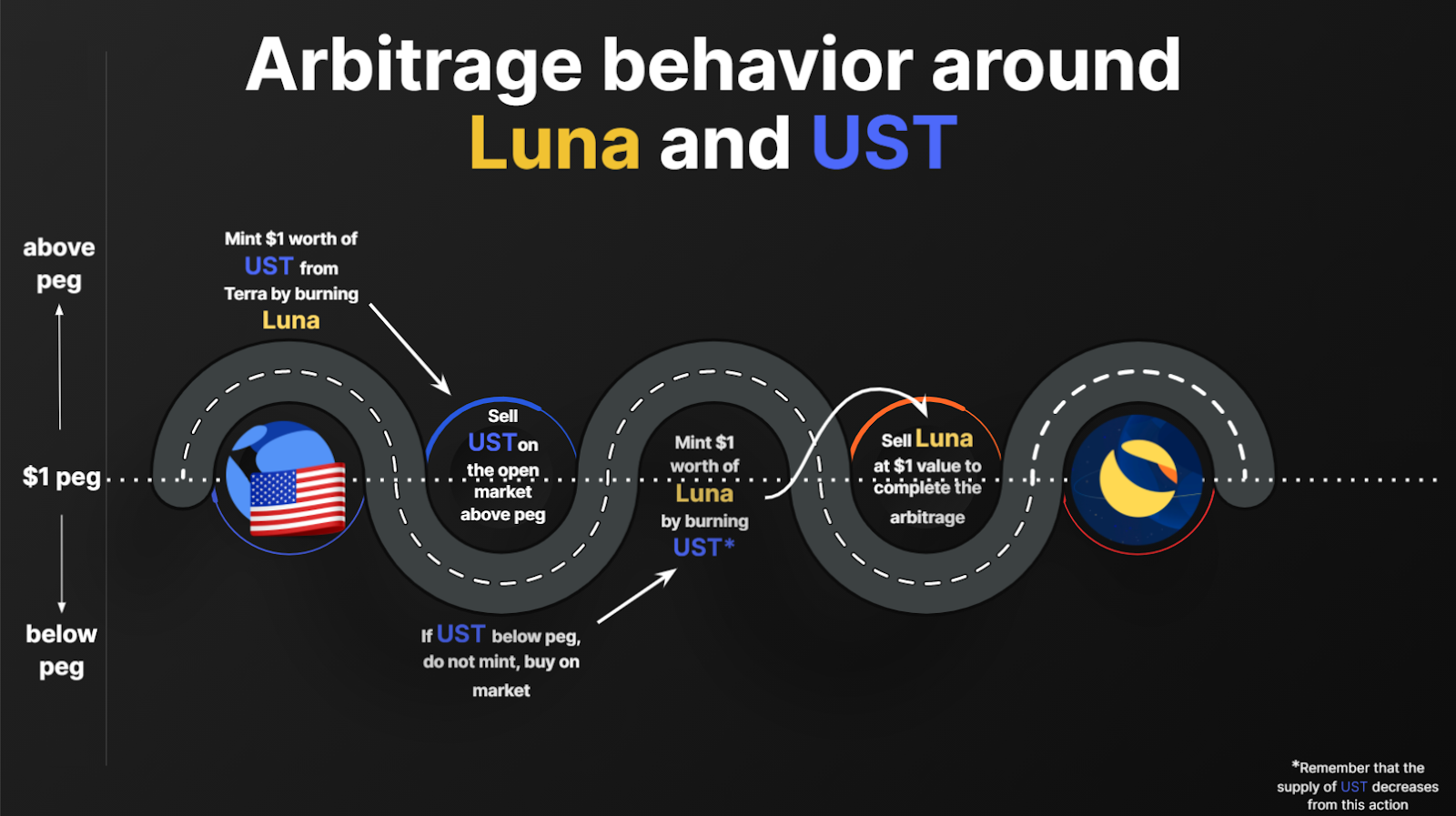

UST is a decentralized stablecoin whose peg is maintained by a mint-and-burn mechanism where one dollar worth of Terra Lunacoin can be burned to mint one UST and one UST can be burned to mint Luna from a dollar to mine.

Terra's algorithmic method

When UST trades above its one-dollar peg, Luna holders are incentivized to burn their Luna to mine UST and make a quick profit. The increase in UST supply eventually brings the UST price back to the one dollar peg. On the other hand, when UST is trading under a dollar peg, it gives UST holders an incentive to burn their UST to mint Luna and make a quick profit. The drop in UST supply eventually brings the UST price back to the one dollar peg. Overall, this is how the value stability of UST is generated.

Of course, this can also become a problem if UST and Luna are both falling rapidly. Then the Luna Coin could go into hyperinflation and the UST still might not be absorbed because you can't print new money as fast as the value of the Luna Coins depreciates. And the faster the amount expands, the faster the inflation and the construct collapses. To counteract this risk, the Luna Foundation Guard (non-profit organization set up to support the growth of the Terra ecosystem) came up with the announcement that they hold a large reserve of Bitcoin. The Foundation backed the UST with Bitcoin, if this stablecoin goes down in value then you have this value stability mechanism, the Anchor Protocol, to counteract small swings and if the price falls really fast, the underlying asset Bitcoin creates some kind of security. For this reason, Bitcoins were regularly purchased in large quantities as a support reserve. Between January and May of this year, 80’394 Bitcoins were bought, which was worth $3.5 billion at the time.

Until a few days ago, Terra (Luna) was a successful network with an innovative stablecoin. Instead of physically depositing fiat currency, as already mentioned, Terra (Luna) relies on an algorithm that is intended to tie the rate to the US dollar. It was precisely this algorithm that became the currency's undoing. Investors who bought Terra (Luna) are now shocked. This anchor protocol or UST as a stablecoin has lost trust.

The Total Value Locked in the Anchor Protocol was approximately $16 billion through the end of April 2022. In May 2022, more and more capital was withdrawn from this protocol within a few days, so that later only about half of it - namely 7.5 billion US dollars - was deposited. This in turn created major problems as back pressures in this market increased for UST. The Foundation has attempted to sell the UST in the market and this has pushed the price down tremendously. In addition, the entire market has fallen, including Luna, which is designed to cushion this falling price. Because of this, the Luna Foundation naturally had to dump the Bitcoin reserves on the market to catch the price of Luna and this stablecoin. These Bitcoins were all sold in the market at once, so this sell-off drove the price of Bitcoin down.

Despite the collapse of the Terra Defi ecosystem, belief in the project is still present in some parts of the crypto community. Many wish for a reconstruction of the project and a fresh start. The blockchain is to be fundamentally rebuilt and the native coins subsequently redistributed. Terra founder Do Kwon has already announced a revival plan.

What does this price slide mean for Bitcoin? Are these short-term price fluctuations actually of great relevance for Bitcoin? Let us know what you think when you get a chance.