Crypto Global

Bitcoin soon again new all-time high

Nov 9, 2021

At the time of writing, Monday morning November 8th, the crypto currency Bitcoin (BTC) is trying to hit a new all-time high. The price has already passed the $ 66,100 mark and is up around 4.6% today only. According to Coinmarketcap.com, the current all-time high is USD 66,930.39. A new all-time high is not far away.

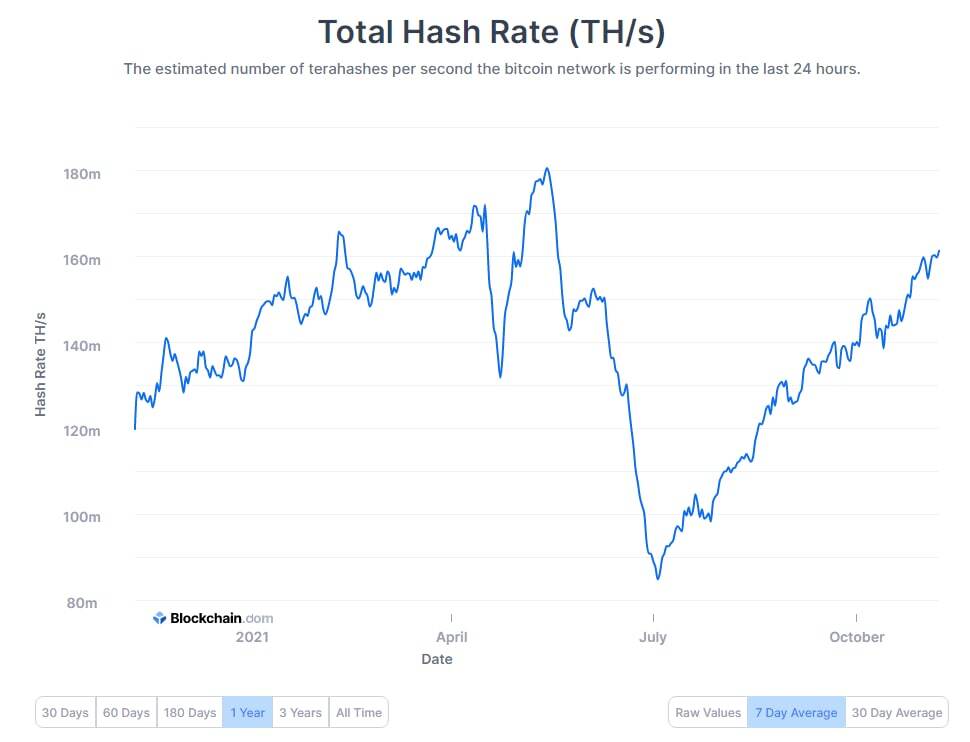

We're not sure if you are aware, however, but the price of bitcoin has driven the hash rate up. The hash rate has changed a lot in the last few months. The difficulty in BTC mining has steadily increased. This is the result of the increasing hash rate of miners deployed on the network. This makes sense as the price of Bitcoin has also increased. Remember when all these miners from China had to shut down their equipment in June because the Chinese government banned mining in China. These miners have reorganized and are now mining outside of China.

You can see this in the chart below when China basically blocked all bitcoin mining in China in May 2021. We saw a huge drop back then. We were at a high of nearly 180 million tera-hashes per second (TH/s), and then we dropped to a low of 84 million TH/s. During this time, the miners made a lot of money because the hash rate went down and the difficulty also went down. Since July 3, the network's hash rate has increased by over 100 percent. At the time of writing, we hit a high of 161 million TH/s.

Source: Blockchain.com, Hash rate

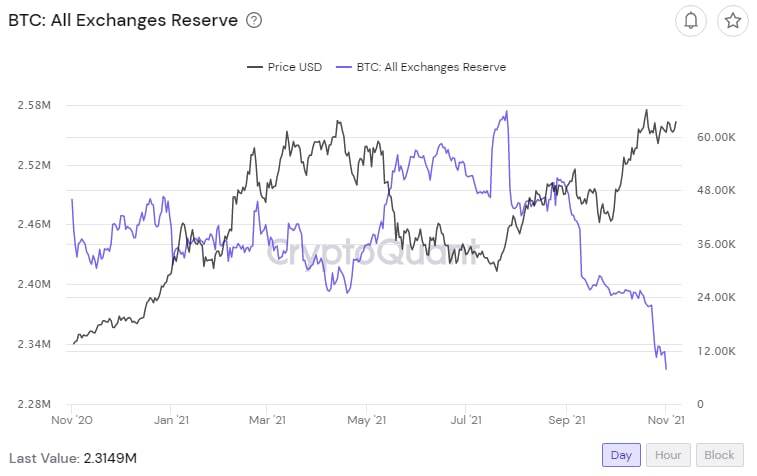

The second metric we're looking at is that of CryptoQuant. This data analysis website offers you graphic visualizations for BTC, ETH and other cryptocurrencies. This gives a trader / investor a better understanding of what other people are doing in the market. It is particularly useful to take a look at the “BTC: All Exchanges Reserve” diagram.

Source: cryptoquant.com, BTC: All Exchange Reserve

This helps to get a sense of whether the market is about to turn bullish or bearish. If you look at the graph below, it means that the availability of Bitcoin to buy in the market decreases when the BTC reserve on the exchanges decreases (see the purple line). Basically, this means that the number of bitcoins that want to be sold in the market is decreasing. The reason for this is that people are pulling their bitcoins out of the exchange and probably keeping them in cold storage solutions. However, when a lot of Bitcoin is flowing into exchanges, we generally know that people are about to sell or are considering selling. This is what people generally do when pulling cryptocurrencies out of cold storage devices. Right now, people are buying Bitcoin, taking it off the exchanges and putting it in cold storage. In other words: The demand for cryptocurrencies currently exceeds the supply.